Dunleavy administration cooks the books with oil price, production guesses

The Dunleavy administration is cooking the books with oil price and production guesses that will help the Dunleavy reelection campaign effort to claim Alaska can afford to pay billions more in dividends over the next decade.

The Dunleavy campaign is “solving” the revenue problem the state faces with imaginary oil dollars over the next decade.

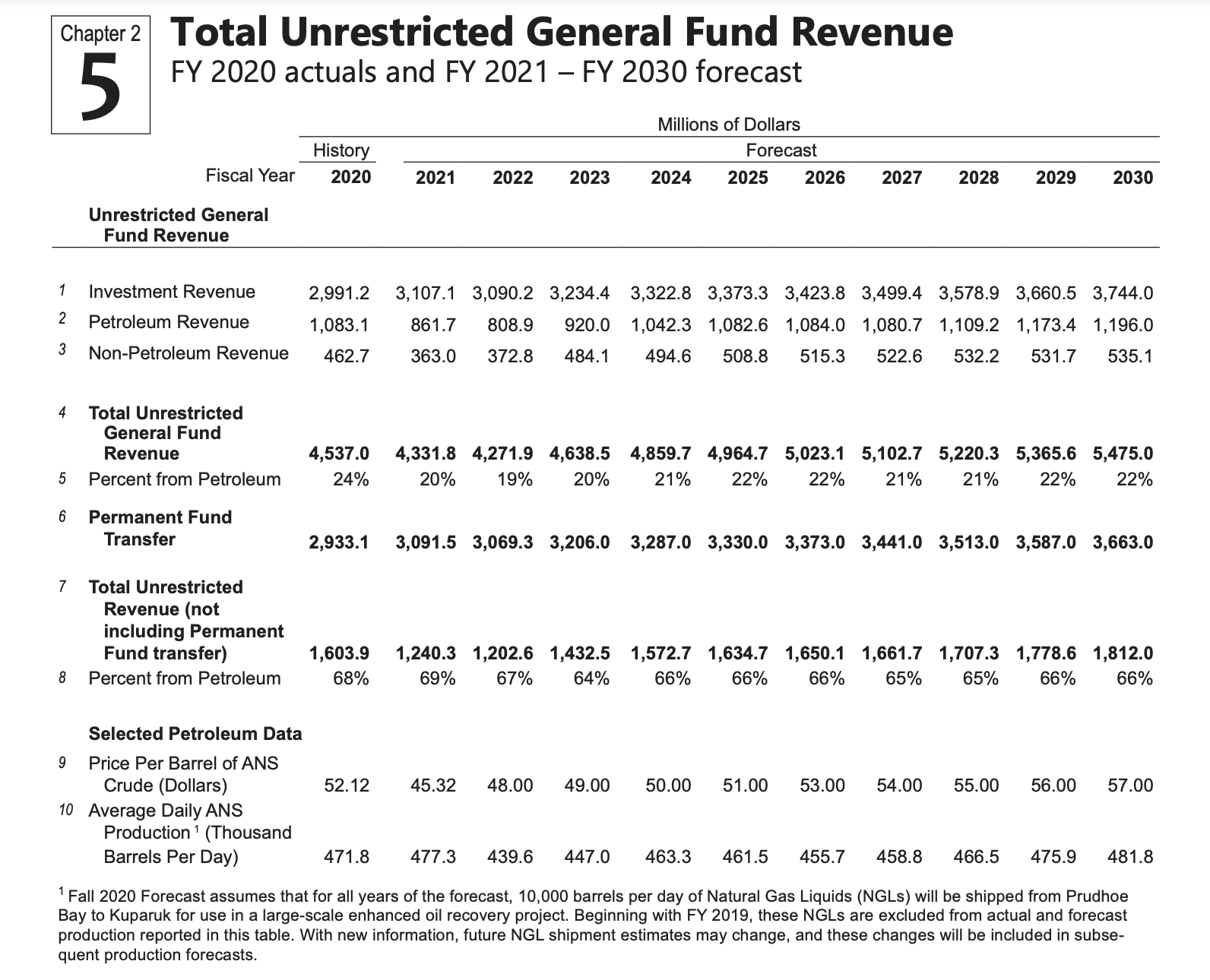

A year ago the state guessed that Alaska oil would be $57 a barrel in 2030 and the state would produce 482,000 barrels a day from the North Slope.

Now the state is guessing that Alaska oil will be selling for $88 a barrel in 2030 and the North Slope will produce 541,000 barrels a day.

The state is guessing that oil will produce $2 billion more for the state than it guessed a year ago. Added together, the new guesses would increase oil revenues from 2025-2030 by about $10 bill

All of these numbers are fiction and not to be relied upon. They can’t even be called good guesses.

The news coverage of the oil price and production guesses fails to make clear that the state computes its oil guesses in a way that no private company, no investor, no utility, no agency, no economist and no competent governor would use. It is not laughable. It’s a con job.

The guess calculation is made this way—take the short-term futures market price for the next fiscal year, which has been boosted by the pandemic disruptions. Bake that temporary increase into the guessing machine and assume that the price will go up with inflation.

This approach excludes the political, social, cultural, technological and environmental factors that are likely to have a much greater impact on the course of oil prices and production than inflation. No serious guess about oil prices in 2030 can be made by using the state approach.

The Dunleavy administration says it began using this technique in 2019 because of the “minimal expense.” It’s cheaper to do it this way, abandoning the old practice of getting experts together to look at the world of uncertainties and make their best guesses about the years ahead on prices and production.

The old approach was never reliable, but at least it was based on some thought.

Under the Dunleavy approach, the state takes no notice of the move to electric cars, the worldwide threat posed by climate change and how governments and industry will respond. In addition, the Dunleavy approach takes no notice of political and environmental conditions in Alaska, the United States and the world.

All of these issues add uncertainty to the price and production guesses. Most of them, but not all, will put pressure on the downside.

Refusing to give any thought to what the impacts will be makes the state guesses close to useless.

The short-term guesses, for the next fiscal year or so, should carry a lower level of uncertainty. Oil prices are up and may remain so.

But even then, the state is cooking the guess book. A year ago, the state guessed that oil production for the fiscal year that starts next July would be 447,000 barrels per day. Now the state is guessing that oil production will be 50,000 barrels a day higher.

Analyst Brad Keithley, who closely tracks production numbers, says the numbers so far this fiscal year do not support a 6 percent production increase the state is counting on to generate about $600 million more through next summer.

Here are the guesses from a year ago:

Here are the new guesses for 2021:

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673