Alaskans have a right to know where $200 million in public funds is going

The printed presentations by two companies hired by the Alaska Permanent Fund Corp. to invest $200 million in public money in Alaska have been released.

What’s missing from the documents created by McKinley Capital Management and Barings are the names and amounts of specific Alaska businesses that have received public money, an amount that will soon reach $200 million.

This secrecy, fostered by the management and trustees of the Alaska Permanent Fund Corporation, is an invitation to political corruption. With the Permanent Fund considering a goal of expanding in-state investments into the billions, the management and trustees need a more transparent approach.

The corporation claims that these details are allowed to stay secret because of a state law that says “information that discloses the particulars of the business or affairs of a private enterprise or investor is confidential . . . ”

There is nothing about identifying names and amounts of state money invested in a business the “particulars of the business or affairs of a private enterprise,” just that public money has changed hands.

Disclosure is necessary for a healthy system of checks and balances.

The real danger is that secrecy can be a tool to hide public investments from the public to avoid controversy and public discussion. It can also be a tool that allows political influence to decide who gets the benefit of state money.

The incumbent governor has two commissioners among the trustees and appoints the other members when terms expire. Most governors, after being in office for a couple of years, end up with a majority of the trustees backing them on major policy questions.

The Legislature is supposed to provide oversight in this system of checks and balances, but doesn’t. Most legislators know little about the $80 billion fund except for the dividend. While $200 million is a small percentage of the overall fund, it is politically significant.

The two companies that received the $200 million to make in-state investments are to give a presentation to the permanent fund trustees at 11:45 a.m. Wednesday. Here is the agenda and information about watching the presentation online.

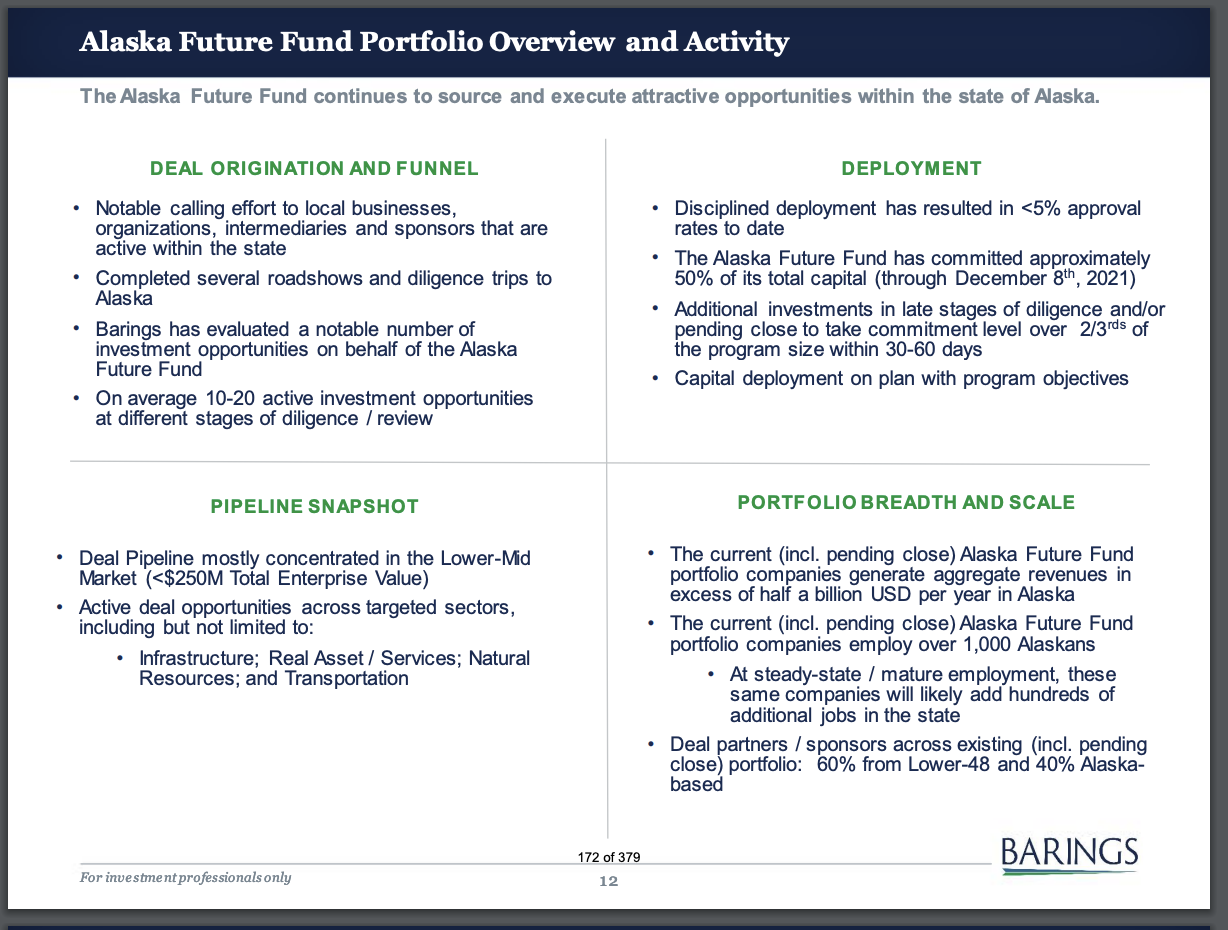

Barings has used its $100 million to create the “Alaska Future Fund.” It says the top goal of the fund is to “generate returns for APFC and its stakeholders, while growing partnerships and fostering more private market opportunities within the state.”

Target industries for development are natural resources, transportation and infrastructure.

Barings says about $50 million of the $100 million has been invested. Its presentation begins on page 161 of this document.

In the next month or two, an additional $15 million will be invested, the company predicts. About 95 percent of those who applied with Barings for a state investment under this program were not accepted, due to the “disciplined deployment” of the money, the company says.

About 1,000 Alaskans work for the companies that the fund is doing business with or will soon be doing business with. Sixty percent of the companies are from the Lower 48, Barings said. It said, “these same companies will likely add hundreds of additional jobs in the state.”

The slide above is from the Barings presentation to be made to the Alaska Permanent Fund Corporation Board of Trustees Wednesday morning. The companies getting money from the state are being kept secret by the permanent fund.

The slide below is from McKinley Capital about a proposed second Na’-Nuk Investment Fund that would be much larger than the first.

It’s not clear from this slide in Rob Gillam’s presentation if his company will be seeking $250 million from the Alaska Permanent Fund Corp. for the second Na’-Nuk Investment Fund. Nearly all of the $100 million in the first Na’-Nuk fund has been invested with 9 enterprises in Alaska.

In his presentation, Rob Gillam of McKinley Capital Management says his company is investing the public funds in energy, mining, food systems, transportation, tourism and Arctic technology.

About $90 million has been committed or invested so far, with a gross internal rate of return of 122 percent in nine separate investments. All of the money in the Na’Nuk Investment Fund 1 is expected to be fully invested by the end of the year, according to one of his slides.

His presentation begins on page 178 of this document.

He mentions a second Na’-Nuk investment fund with a target size of $250 million to “fully capture opportunities.”

It’s not clear if his company has asked for $250 million more of state money to disburse. The second fund would bankroll 15-20 larger investments.

If and when those investments take place, the public deserves to be kept in the loop, seeing as how this is public money, not private money.

If the fund has given McKinley Capital and Barings direction that the private companies they invest with can expect that their names and the amounts will be a state secret, that mistake needs to be corrected.

If the Permanent Fund won’t do it, the Legislature must.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.