Dunleavy aims to disguise state deficit, boost re-election campaign, with $3 billion transfer

The Dunleavy administration claims to have “a structured disciplined fiscal plan that provides a framework that leads us to fiscal certainty.”

Unless and until the Dunleavy administration begins to tell the truth about the level of state and local government services and how to pay for them, there is no structure, discipline, framework or hope of “fiscal certainty.”

Dunleavy is setting himself up to run for re-election in 2022, still the champion of the Big Dividend Promise.

But what he and his underlings are saying now is as disconnected from reality as the claim he made up in 2018 that he would eliminate 2,000 funded, but unfilled state jobs, and save an easy $200 million.

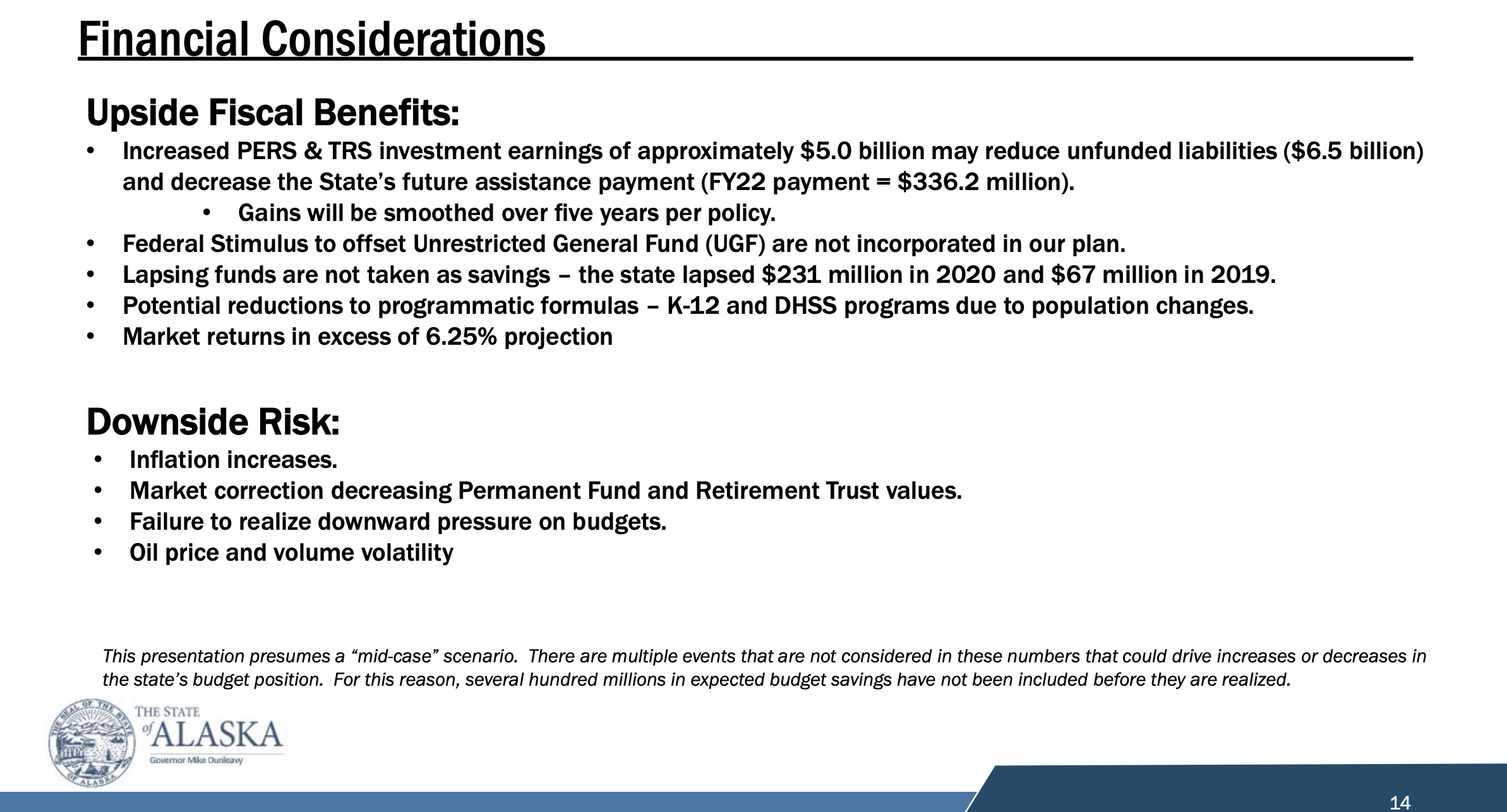

Dunleavy’s revenue commissioner, Lucinda Mahoney, tried to defend the Fiscal Fantasy Tour 2.0 Thursday before the Senate Community and Regional Affairs Committee with a smoke and mirrors presentation, treating imaginary numbers as real numbers.

The state has made one rosy assumption after another to back up the Dunleavy attempt to avoid taxes and show a budget surplus within a few years.

She said the PFD belongs in the Constitution to create consistency. Failing to do so,“may result in us setting up tax programs that overtax our citizens. We want to establish fiscal sustainability in a method that taxes our population in the least amount.”

The heart of the Dunleavy miracle cure is to refuse to call the state deficit a deficit.

Instead, the idea is to take an extra $3 billion out of the Permanent Fund to disguise deficits for the next few years, buying more time to pray for higher oil revenues and increased investment earnings.

This would allow Dunleavy to get past the next election without taking any tough positions on cutting state and local services or new taxes. It’s the exact same logic by which the state squandered a fortune from the Constitutional Budget Reserve.

The $3 billion and hoped-for earnings from the Permanent Fund will lead to better times in a few years, according to the campaign spin from Dunleavy and his revenue department.

“We don’t believe that at this point it requires a broad-based tax,” Mahoney said.

“We estimate that with a $3 billion transfer from the ERA into the CBR that is then supplemented by additional new revenues as well as reductions in ‘23 and ‘24, that we’ve achieved a framework to fiscal sustainability into the future.”

Mahoney claims the so-called fiscal plan forecasts a “fiscal gap” of about $300 million in the fiscal year that begins July 1, 2024. Because the $3 billion will be used to create a slush fund to obscure the deficit, the $300 million figure is political fraud.

“What the $3 billion does is it provides for time for the Legislature and the governor to work together to identify new revenue measures as well as potential reductions that we can get into statute and then provide the time for the administration to get the tools in place to actually implement the tax and then be able to collect the tax for the new revenue measure. Or implement whatever expenditure reduction, depending upon what is concluded,” she said.

What this means is that Dunleavy does not want to propose spending reductions or taxes before his 2022 re-election campaign. He merely wants to keep proposing big dividends, while disguising the financial impact and drawing billions more from the Permanent Fund.

Under the Dunleavy plan, the state would have to cut the budget or increase taxes by $300 million in 2023-2024, long after the next election.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.