Watch Robin Brena cut through oil industry propaganda in compelling legislative presentation

Anchorage oil and gas attorney Robin Brena made the case for revising the oil tax law and approving SB 114 in his testimony to the Senate Finance Committee this week.

Anchorage Sen. Bill Wielechowski said it might “be the most important testimony to the Legislature this year.”

Brena is among the tiny group of people in Alaska—outside of the oil industry—who qualify as independent experts on the inner finances of the oil companies.

Brena has spent decades representing oil companies, municipal governments and other parties in state and federal court and administrative proceedings that deal with the intricate and technical details of oil finances. It is this background and his professional research that sets him apart.

The two main levers that determine whether Alaska is getting what it should from oil developed on state lands are royalties and production taxes. “We’re getting a half to two-thirds of what other people are getting,” he said.

In the decade since the enactment of SB 21, the state has collected $4.5 billion in production taxes and provided $5.6 billion in per barrel credits. The credits mean the alleged 35 percent oil tax is a joke.

“I would call that underperformance on a massive scale,” he said. Here are his slides.

One of the alarming points to consider is about the lack of transparency that marks our situation with Hilcorp, which is privately held by Texas billionaire Jeff Hildebrand.

“The people at this table do not know if Hilcorp has $1,000 in its bank account. Nobody does. There is no transparency. This is the first time the largest owner of TAPS, the largest owner of the Valdez Marine Terminal and nobody at this table has a clue if they have a million dollars—if there’s another Exxon Valdez oil spill—on their balance sheet, or whether it’s all flowed through of what their status is,” he said.

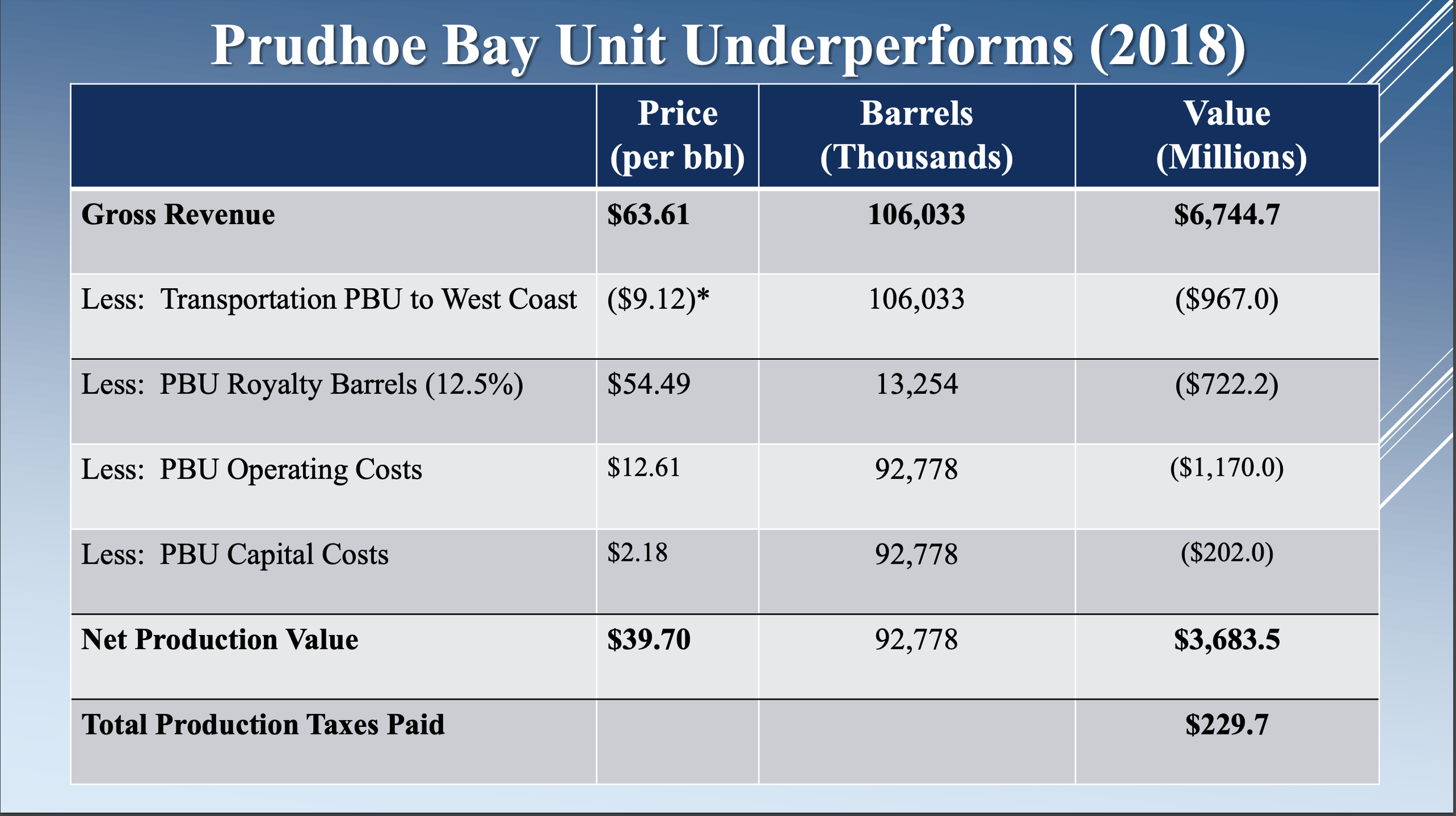

A lack of transparency also obscures the real economics of the North Slope. It is a good bet that no one in the Legislature knew the information contained in the slide below about Prudhoe Bay costs because it is not published in the annual revenue sources book.

Using 2018 as an example, he said the operating costs of Prudhoe Bay, were $12.61 per barrel and the capital costs were $2.18 per barrel. Subtract transportation and royalty costs and the net production value at $63 a barrel is nearly $40.

On gross revenues of $6.7 billion, total taxes paid were $229.7 million.

We don’t have a significant number of legislators or legislative staffers who are experts on the oil industry, a chronic deficiency that puts Alaska at a serious disadvantage when it comes to dealing with some of the biggest companies in the nation, who have a duty to put their shareholders first.