Permanent Fund returns would have been higher without fossil fuel investments, study claims

The Alaska Permanent Fund would have been better off divesting from fossil fuel companies a decade ago, according to a new study from the University of Waterloo.

The study found that the Permanent Fund would have $1.5 billion more, which is about $2,000 per Alaskan.

The rebound in energy prices over the past few years narrowed the gap somewhat, and it is risky to make solid conclusions from a single study, but the data and the analysis is worth your time to review.

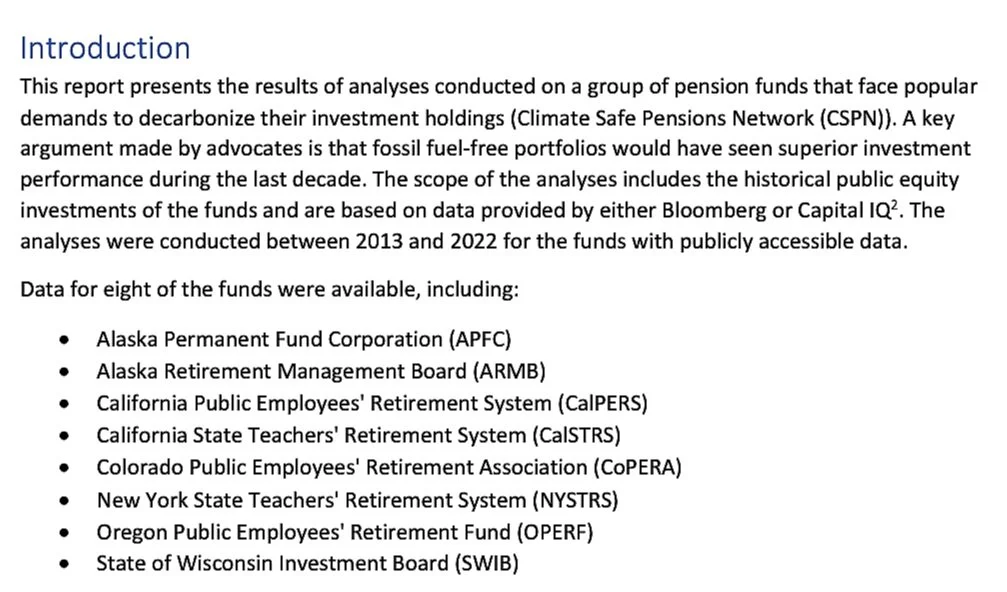

One finding of the report that stands out to me is how the returns of the Alaska Permanent Fund Corp., listed below as the APFC, compare to the pension funds selected for comparison.

The APFC has a different set of beneficiaries—all present and future Alaskans—than a public pension fund that is designed to benefit retirees, and the investment mix is not going to be identical, but the APFC had lower returns than several of the retirement funds studied.

But the APFC returns were significantly higher than those of the Alaska public employee retirement funds, listed as the Alaska Retirement Management Board. This is a topic that deserves more attention by Alaska news organizations and a full explanation by the state of Alaska.