Permanent Fund still wants to borrow billions to try to speed its growth to $100 billion

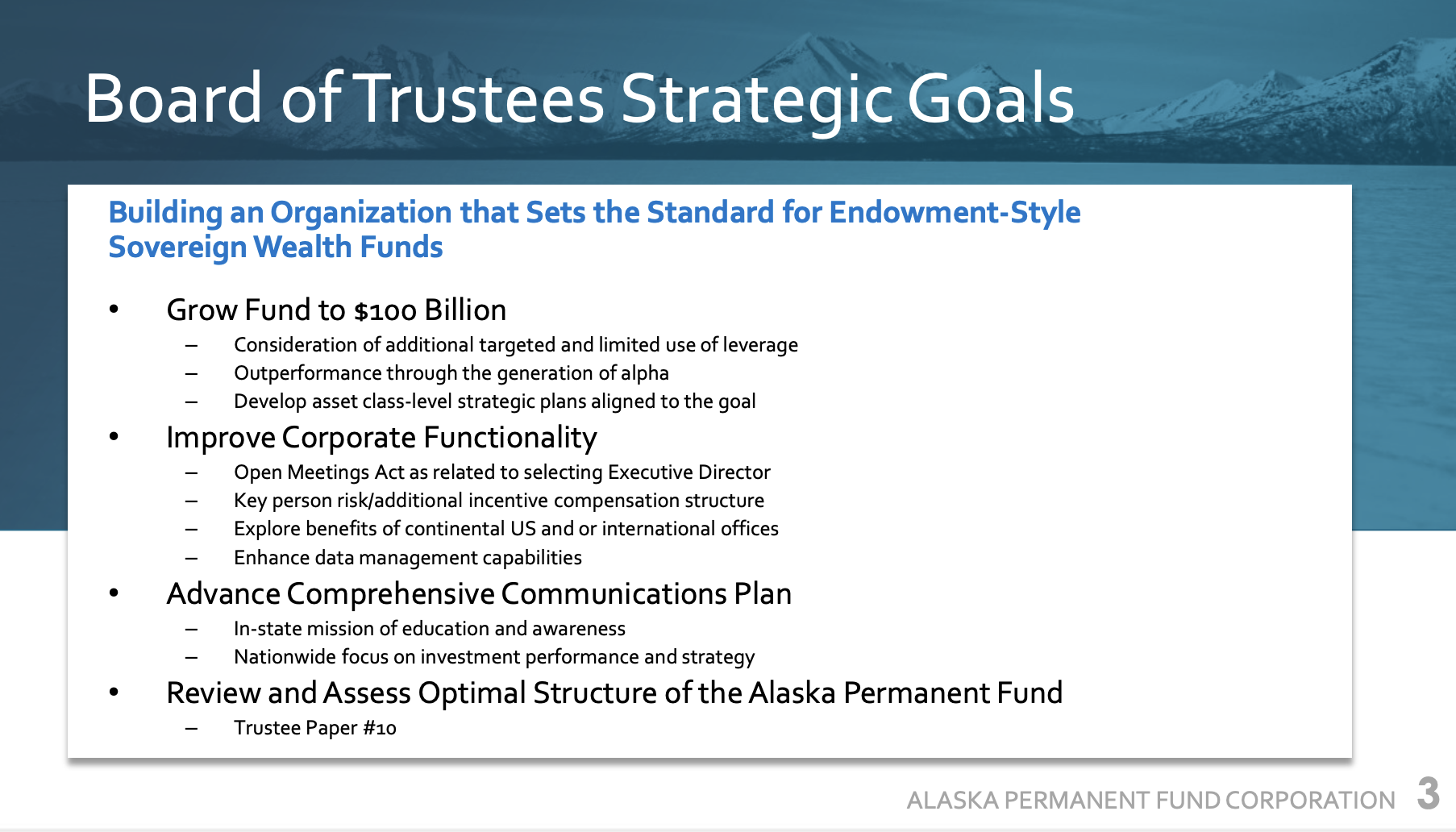

The trustees of the Alaska Permanent Fund Corporation want the Legislature to allow the corporation to borrow several billion dollars that it can invest with the hope of speeding up the growth of the $78 billion fund to $100 billion.

The idea to borrow 5 percent to 10 percent of the value of the fund is a key element in the proposed strategic plan that the fund has now made available for public comment.

I doubt the Legislature will give the fund the power to borrow billions this year. It shouldn’t do so until there is a much better understanding of the risks and rewards.

You have a week to comment on the proposed strategic plan. The comment period began Wednesday and ends next Friday, February 2, at 5 p.m. Send comments to boardpubliccomment@apfc.org

There is also an online comment feature at the Permanent Fund site.

The fund has released this detailed memo on the strategic plan.

The memo, which reads like a business school lesson, is clogged with investor jargon, industry catchphrases and puffed-up language that conceals more than it reveals. The memo is not suitable for a general audience or anyone who wants a clear picture of the fund’s strategy.

The fund may be the most complicated part of state government. Though its work is complex, the fund and its operations can be described in simple language to the average Alaskan.

For instance, instead of saying the $78 billion fund wants to borrow up to $4 billion or $8 billion and invest that money in ways that could generate billions in extra income, while taking on more risk in down markets, the strategic plan memo introduces the topic this way:

“Introducing tactical leverage at the fund level, with carefully defined parameters through a statutory change, will provide the fund with additional tools to navigate and capitalize on potential opportunities.”

There is a lot hidden in that nightmarish sentence.

And instead of saying the fund wants to raise employee expectations so that they generate profits well beyond industry standards, the fund says the goal is “Outperformance through the generation of alpha (i.e., achieve investment performance that exceeds benchmarks.”

“To achieve alpha and ultimately realize growth, ongoing assessment and procurement of resources to enhance the organizational structure and streamline processes are essential.”

I think the good news about the strategic plan is the fund trustees removed the proposal they considered last fall to try to speed the fund’s growth to $100 billion by increasing the target rate of return—above 5 percent plus inflation—and taking on riskier investments.

“My baby has been our $100 billion strategic plan that we will hit over the next three to five years. So we’re unveiling that next week,” Trustee Gabrielle Rubenstein predicted at the “Davos in the Desert” conference in Saudi Arabia in late October.

I wrote about this topic on numerous occasions in September and October, but it wasn’t until investment experts called for more caution that the trustees abandoned her three-to-five-year “baby” and dropped a timeline.

They still haven’t explained how borrowing billions and creating alpha are the right combination for Alaska’s future.

Other items on the strategic plan that need more discussion with the Legislature and the public are: the idea of opening one or more Permanent Fund investment offices in the Lower 48 or overseas; the attempt to keep applicants for executive director secret; the need for a national and global communications plan; and whether incentive compensation could push some Permanent Fund employee strategies to levels rarely or never seen in state government.

That the trustees are taking public comments now on the strategic plan is good. They need to hear from Alaskans, work closely with the Legislature and allow more time for public comments.

A month would be better than a week and two days.

The Permanent Fund says its plans to increase its communications with Alaskans, which is good. Such is the transient nature of our state that there are hundreds of thousands of people in Alaska who know nothing about the Permanent Fund, except that it is somehow the source of dividends, a topic on which everyone is an expert.

A great deal more work needs to be done by the Alaska Permanent Fund Corporation to build public trust and understanding of the fund’s operations, management and investments so that it will be here for the long run.

As I wrote here in September, the strategic plan does nothing to fix a grave imbalance in a management structure that made sense 40 years ago, but no longer. The Dunleavy administration has taught us this much.

Far too much power to control Alaska’s most important financial institution is vested in one individual, the governor, who appoints all six trustees and they do not have to be confirmed by the Legislature.

When the governor chooses trustees from a small circle of supporters, as Dunleavy does, the risk of concentrated power in the handling of tens of billions is far too great to be ignored.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.