Permanent Fund needs a modernized structure, but this isn't about the dividend, so no one pays attention

If you see or hear a claim that the Alaska Permanent Fund ended the fiscal year June 30 with a $428.3 million shortfall—and you might—don’t jump to conclusions.

This is more about the antiquated structure of the $80 billion fund than it is about recent performance. For nearly a quarter-century, the advice from financial experts has been clear—the fund needs a modern structure that provides more flexibility in dealing with tens of billions in global assets.

Flexibility means giving investment managers the ability to avoid a future risk that the earnings reserve of the Permanent Fund will not be large enough to meet the expectations of elected officials responsible for the state budget.

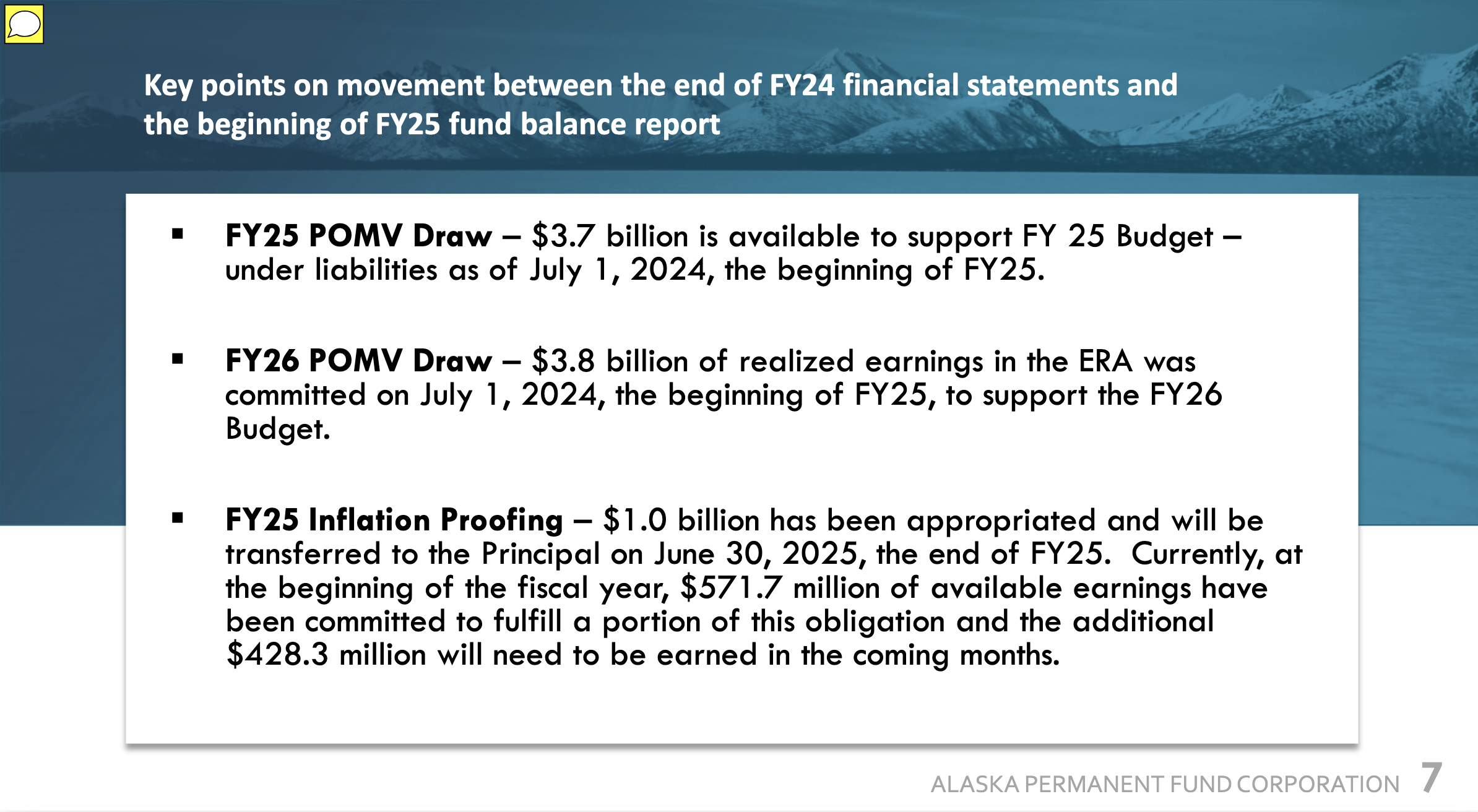

Here’s what the Permanent Fund says about the latest numbers.

Here’s what the Permanent Fund says about the durability of the fund.

Because the political debate is always about the dividend and nothing else, there will be no change until the governor, the Legislature and Alaska’s leading institutions focus on the cash crisis that could happen if the rigid structure remains in place. That should be enough to get Alaskans to pay attention.

People running for office almost never talk about this issue because it is not directly related to the size of the dividend and it cannot be compressed into simplistic talking points or campaign ads.

That, plus they see that the eyes of every listener revert to a Homer Simpson stare when anyone mentions percent of market value.

The leadership on this has to start with the governor, but Gov. Mike Dunleavy has long since checked out.

He is content to simply announce every year that he wants big dividends and no taxes—while doing absolutely nothing to build a coalition of Alaskans to deal with an array of complex challenges.

Recycling slogans about dividends doesn’t move the state any closer to a fiscal system that works and preserves the financial foundation of state government, which is what the Permanent Fund has become.

The fund ended the fiscal year June 30 with enough cash on hand to provide $3.8 billion to the state government to pay for state services and dividends for the 2026 fiscal year, which begins next July 1. This money is designated a year in advance.

The amount represents the so-called percent of market value draw—in this case 5 percent. It is money used by the governor and Legislature to pay the bills for state services and dividends.

The fund did not end the fiscal year June 30 with enough cash on hand to designate $1 billion for inflation-proofing the fund next summer on June 30, 2025.

The fund has set aside $571.5 million for that purpose, leaving $428.3 million to be generated this fiscal year. The Permanent Fund has investments that pay regular dividends and it collects interest, earnings that are dependable.

The two-account nature of the Permanent Fund is a systemic flaw for a modern diversified fund. It will require a constitutional amendment to modernize the language that separates principal and earnings.

The Permanent Fund can only spend realized earnings. It has more than $12 billion in unrealized gains, however, which represents money that can not be spent because the underlying investments have not been sold.

Decisions on when to sell long-term investments should not be made on the basis of whether the Legislature and governor decide that cash is needed for one reason or another. The potential for political pressure is one of the risks created by the current structure.

This is one of the slides from the Alaska Permanent Fund Corporation about the depleted status of the earnings reserve,, which comes at a time when the fund has more than $12 billion in unrealized earnings.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.

Write me at dermotmcole@gmail.com.