Permanent Fund loses $3 billion in Trump stock market crash

UPDATED: The Alaska Permanent Fund has shed $3.2 billion of market value so far during the Trump Liberation Day stock market crash, dropping from $81.7 billion to $78.5. billion.

This does not count the numerous other state accounts, including the pension systems, that have tens of billions more invested in stocks. They do not post daily market values, the way the Permanent Fund does.

The Permanent Fund’s stock holdings stood at $26.1 billion on April Fools’ Day, last Tuesday.

Then came Liberation Day and Trump’s global trade war, which led to the loss of trillions of dollars Thursday and Friday.

The Permanent Fund stocks slid to $25.4 billion Thursday, $24.6 billion Friday and $23.9 billion Monday.

The fund said its private equity accounts rose during the week from $14.5 billion to $14.6 billion. It real estate holdings dropped by about $50 million.

Its cash accounts dropped from $1.2 billion on Tuesday to $455 million Monday. The cash decline was due to “rebalancing transactions,” said CEO Deven Mitchell. That is the practice of moving money between asset classes to buy when prices drop and sell other assets when prices increase.

Here is the April Fools’ Day snapshot of its holdings.

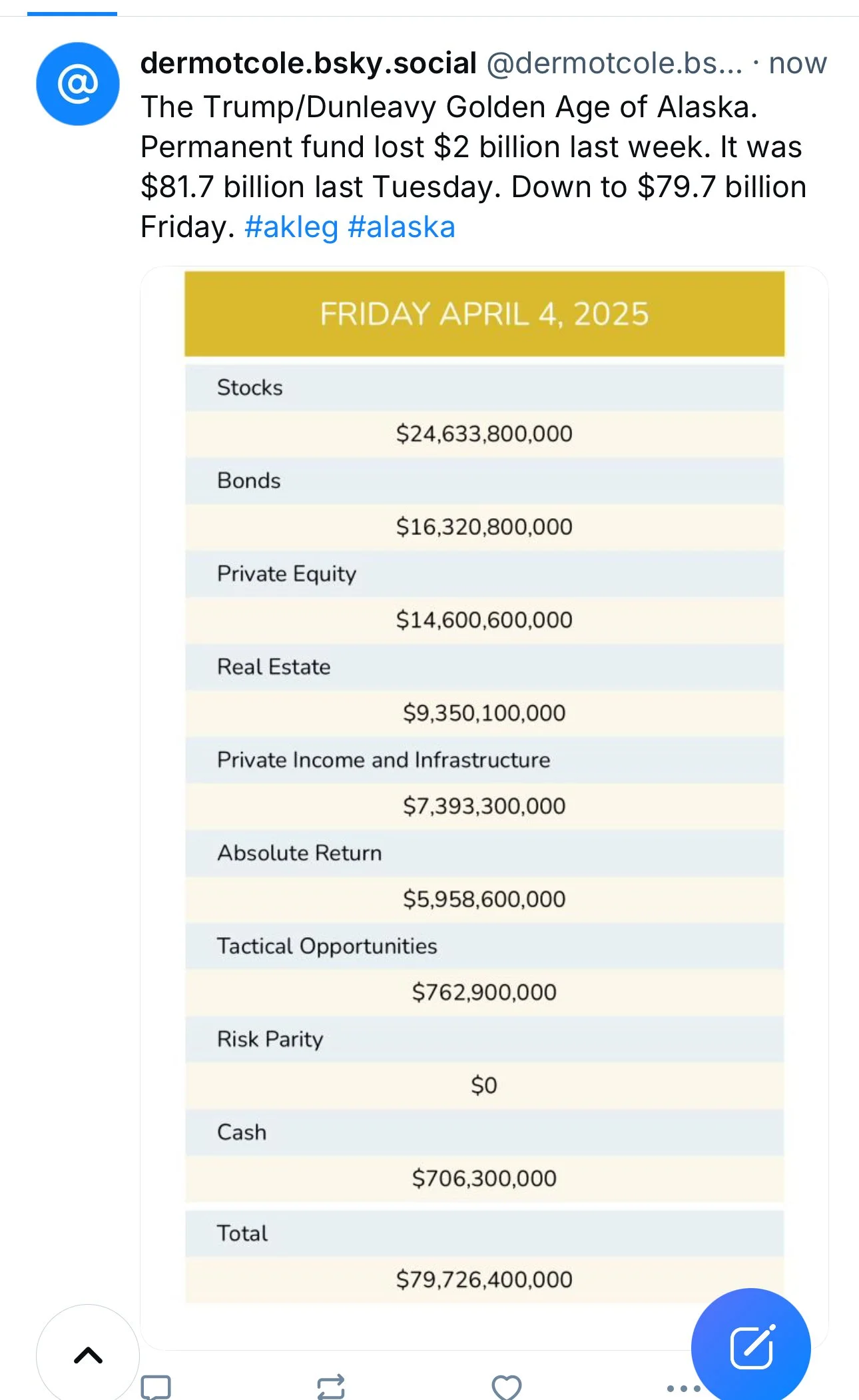

Here is the Friday snapshot of its holdings.

It is important to note that there are often large declines in the value of the fund and a long-term horizon is its prime directive. Day-to-day fluctuations may be important, but not necessarily so.

The fund is diversified, which is a good thing.

As panic about the pandemic spread worldwide in 2020, the Permanent Fund lost nearly $8.5 billion in market value over 18 days.

The decline was real and short-lived. In 2008, when the world economy was in free-fall, the fund lost $9 billion in about 10 weeks.

The biggest difference with this decline is that it was created by the actions of one man.

Gov. Mike Dunleavy has announced that with Trump in the White House every day is Christmas for Alaska. This is the Golden Age for Alaska, according to the Alaska Republican Party, Dunleavy, Sen. Dan Sullivan and Rep. Nick Begich 3.

There was a more accurate term for this age in a column in the Toronto Star by Bruce Arthur: “Trump launches golden age of stupid.”

Meanwhile, after a busy weekend of golf, Trump celebrated the crash in oil prices, which will add hundreds of millions to the Dunleavy deficit in the next fiscal year.

Oil prices are down because the chances of a recession are much greater than they were on April Fools’ Day.

Lower oil prices would mean that oil companies would be less likely to launch new Alaska oil projects.

The state’s spring revenue guessbook, released with fanfare by governor hopeful Adam Crum on March 12, is already out of date because it was based on the futures market.

The guessbook was based on oil prices of $74.48 per barrel for the fiscal year that ends in July and $68 for the next fiscal year.

When a recession looms, oil prices drop.

“U.S. oil futures settled near $61 a barrel on April 4 — well below the $65 that many companies need to profitably drill new wells in Texas and surrounding states, according to a recent survey by the Federal Reserve Bank of Dallas,” Bloomberg reported.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.